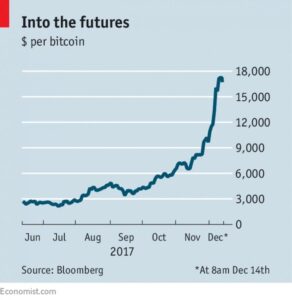

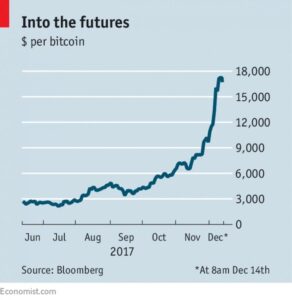

The Bitcoin “market” is spiking, with one Bitcoin now “priced” above $17,000 (by the time this is published it will likely be far different). This latest speculative frenzy has been boosted by the new Bitcoin “futures market.” The quotation marks above allude to the ongoing debate about whether Bitcoin’s current and future value to society is real or imaginary. Monetary reformers appreciate the role Bitcoin has played in opening up the discussion about alternative and especially digital currencies, and in understanding our existing debt-based fiat currency system. However, the recently reported real-world environmental impact of Bitcoin may be a fatal flaw, if its skyrocketing energy use counteracts the world’s efforts to combat climate change. Learning about the flaws of the current monetary system is important, but monetary reform experiments must be premised on saving the biosphere, not endangering it.

The Bitcoin “market” is spiking, with one Bitcoin now “priced” above $17,000 (by the time this is published it will likely be far different). This latest speculative frenzy has been boosted by the new Bitcoin “futures market.” The quotation marks above allude to the ongoing debate about whether Bitcoin’s current and future value to society is real or imaginary. Monetary reformers appreciate the role Bitcoin has played in opening up the discussion about alternative and especially digital currencies, and in understanding our existing debt-based fiat currency system. However, the recently reported real-world environmental impact of Bitcoin may be a fatal flaw, if its skyrocketing energy use counteracts the world’s efforts to combat climate change. Learning about the flaws of the current monetary system is important, but monetary reform experiments must be premised on saving the biosphere, not endangering it.

Bitcoin is a wannabe currency, created by computers crunching an obscure algorithm. Libertarians want to use it to conduct economic transactions and circumvent the State and banks, which they think are corrupt. Conventional wisdom is that some Bitcoin users are trying to avoid paying taxes, and others want to conduct shady business in the black market of the “dark web.” A few may be interested in the more academic topic of digital currency and “blockchain,” the encrypted math behind Bitcoin.

In keeping with its libertarian roots, Bitcoin’s basic metaphor is gold, and people that own the computers that run the programs that create Bitcoins are called “miners.” Bitcoin’s designers gave it a built-in scarcity – by requiring for its creation mathematically complex equations using immense amounts of computing power. It was recently reported that Bitcoin is already using more electricity than 159 individual countries. As CNN reported, if it keeps increasing at this rate, Bitcoin mining will consume all the world’s electricity by February 2020:

“Without a significant change in how transactions are processed, bitcoin could be consuming enough electricity to power the U.S. by the middle of 2019. Six months later, that demand could equal the world’s power consumption.”

Based on these energy use and climate impacts, policymakers have reason to consider legislation limiting, restricting, or even banning Bitcoin. This will enrage the libertarians whose goal was to be free of such regulations, but if Bitcoin’s developers desire a livable planet in the future, they should put immediate resources into turning it into a carbon neutral or even carbon negative currency by 2020.

Beyond the ecological impacts, the Financial Times published concerns about “What happens when bitcoin’s market cap overtakes world GDP?” Bitcoin’s rise can help raise awareness of the problem of trillions of dollars in fiat currency sloshing about related to quantitative easing (free money to the banks), foreign exchange rate speculation, and the petro-dollar cycle (money paid by oil consuming countries to oil producers such as Saudi Arabia, which then need to find places to stash their money), to name a few examples. These seem to be the dynamics leading to speculative bubbles divorced from the reality of economic production, which threaten to burst and crash the global economy.

If Bitcoin is put on hold or goes away, others will continue experimenting with the blockchain technology. Some observers such as Graham Barnes of the Irish non-profit FEASTA believe there may be a way to design an environmentally benign digital currency that can improve on the current system.

A more environmentally-friendly monetary reform concept would be to base a currency on clean energy/greenhouse gas emissions (GHGs). GHGs will have real scarcity in the 21st century if we want to have a livable planet (in this way it could be the gold of the 21st century), and are tied into the economic productivity of clean energy technologies.

A future economic system, as described in Richard Douthwaite’s Ecology of Money, could feature:

· A universal basic income

· Debt-free money such as that advocated by Positive Money or issued through Quantitative Easing for the People

· A local exchange currency

· A climate-friendly GHG-reduction/clean-energy currency

Supporting and developing these alternatives will require more conversations and education about the nature of money, monetary reform, and ecological sustainability. So let’s free up some of that computing capacity, and put some human-made computer keystrokes to good use with articles about sustainable monetary reform that will help solve our ecological-climate-planet-livability deficits and economic-inequality problems.